Evaluate Policies Which Might Be Used to Reduce Income Inequality

AQA Edexcel OCR IB Eduqas WJEC. Progressive taxes such as higher rates of income tax will take a higher percentage of income from the rich.

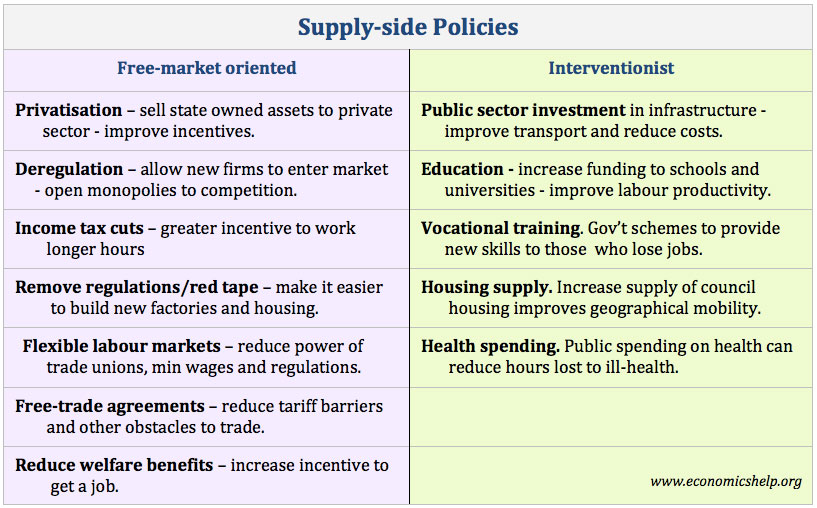

Supply Side Policies Economics Help

And a tax on inheritance.

. Trying to assure that a ladder of opportunity is widely available. Its budget deficit assuming economic growth remains weak. Why economic growth may not reduce income inequality.

Why The Inequality Gap Is Growing Between Rich And Poor 31st May 2019. Here is an essay plan for a question on inequality. One of the most direct and efficient ways to address inequality is to raise the federal minimum wage.

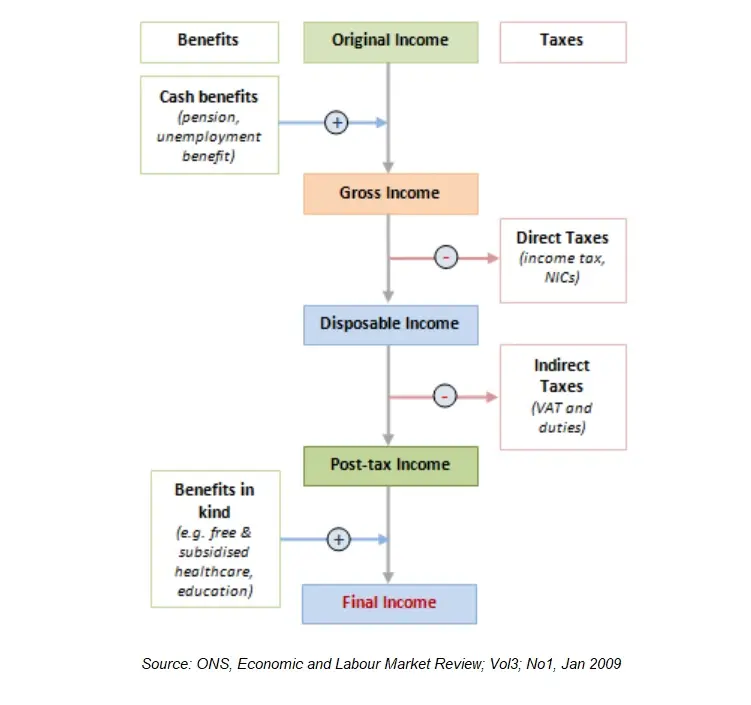

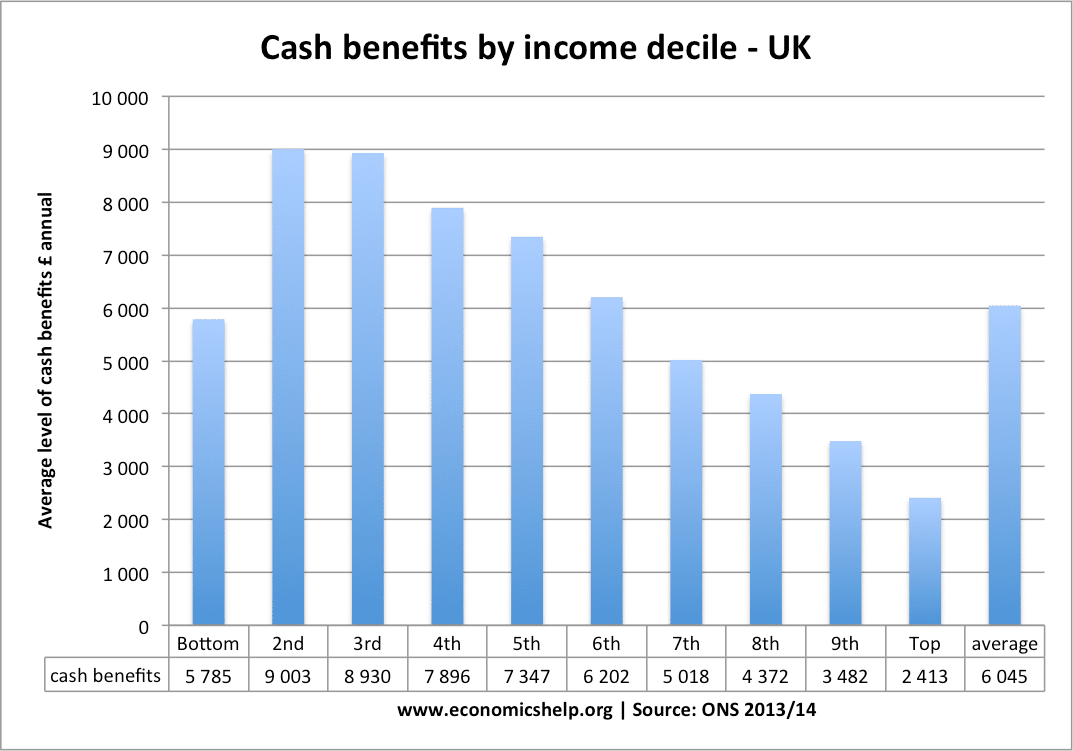

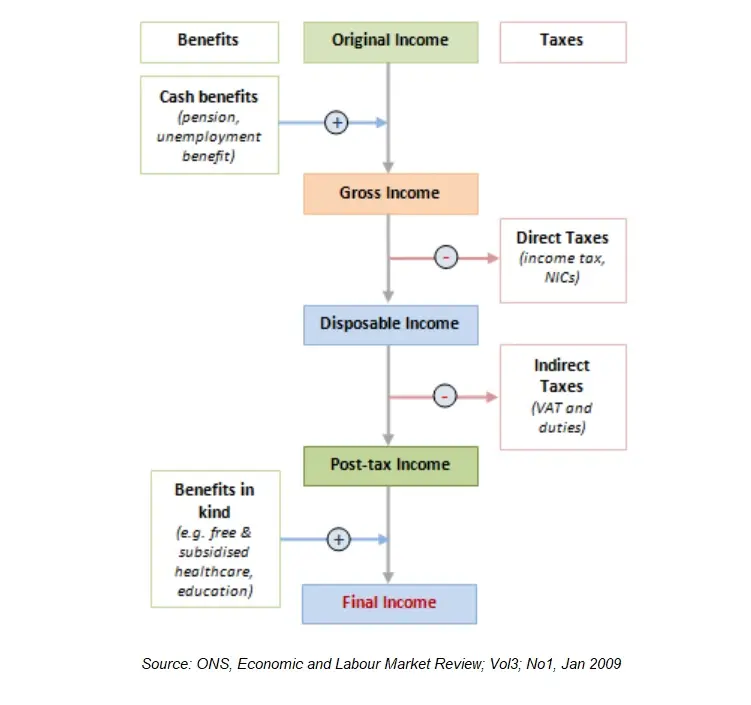

We found that the ACA reduced income inequality and that the decrease was much larger in states that expanded Medicaid than in states that did not. Governments can intervene to promote equity and reduce inequality and poverty through the tax and benefits system. Analysis of fiscal policy.

Explain a policy that may reduce inequality in. Investment in training- An example of this is subsidies for work place traininginternships. How Tax and Spending Policies Can Reduce Poverty and Inequality 20th September 2017.

15 Explain how an increase in investment might lead to economic growth. Earlier in this chapter we considered some of the key government policies that provide support for the poor. Income inequality is defined as an unequal distribution of income between the masses or a situation when a large proportion of total revenue is held by the small percentage of the population which is possible due to various reasons such as the variation in sources of income number of dependents easier availability of resources etc.

Last updated 1 May 2018. While average workers wages have remained. Results have shown that a policy mix of sales tax income tax and government expenditure help to reduce income inequality while at the same the lessen economys financial dependency.

Discuss the extent to which fiscal policy alone can reduce income inequality. Evaluate the policies a government may use to increase the full employment level of national income. By contrast indirect taxes such as VAT act to increase income inequality.

The welfare program TANF the earned income tax credit SNAP and Medicaid. This can be used to fund social spending such as health care education and welfare benefits which help to reduce income inequality. Up to 24 cash back an explanation of how supply-side policies may work to reduce unemployment in the longer term use of ADAS analysis showing LRAS shifting to the right.

Progressive taxes redistribute income. If a society decides to reduce the level of economic inequality it has three main sets of tools. Below we offer eight ways to move the world forward in reducing global inequality.

The inefficient distribution of resources in an economy. 30 marks Essay 6. 30 marks Essay 5.

Evaluate macroeconomic policies which may be used to reduce the level of unemployment in the UK. However if income tax is increased there is a risk of brain drain and increased tax avoidance. Redistribution means taking income from those with higher incomes and providing income to those with lower incomes.

Policies such as free education and healthcare appeals to the root of the problem which is. Micro Macro Policies to reduce Income Inequality Student Videos. And a tax on inheritance.

However in the framework of computable general equilibrium. Evaluate the macroeconomic effects of the UK government trying to reduce. This means employing a progressive tax and benefits system which takes proportionately more tax from those on higher levels of income and redistributes welfare benefits to those on lower incomes.

Redistribution from those with high incomes to those with low incomes. If a society decides to reduce the level of economic inequality it has three main sets of tools. Raise the minimum wage to 1010 per hour.

Direct taxes act to reduce income inequality though by a smaller amount. The tax and benefits system. Evaluate government policies that could be used to reduce income inequality and wealth inequality in a developed country of your choice.

Evaluate the view that the best way to reduce income inequality in a country is by using progressive taxation. Sales tax and the imposition of agriculture tax is an effective distribution policy tool. Redistribution from those with high incomes to those with low incomes.

Overall the above literature shows that fiscal policy can play an effective role in. There has also been less variation in the impact of direct taxes over the time studied with a typical reduction in income inequality between 3 and 4 percentage points. Used to show the degree of inequality of income in a society.

Computable General Equilibrium CGE Social Accounting Matrix SAM Fiscal Policy Income inequality Budget Deficit. Trying to assure that a ladder of opportunity is widely available. Governments can use alternative approaches to reduce the amount of inequality in an economy.

Cuts in income taxes. Increase in disposable income Impact on consumption Impact on aggregate demand real output and employment But. Distinction between income and wealth inequality.

How economic inequality might affect a societys well-being. A progressive tax on the rich will lowers inequality while also raising revenue. In developing countries inadequate resourcing for health education sanitation and.

Tax cuts may be used to repay debts or to increase savings or may be used to purchase imports Difficult to implement for countries with huge budget deficits and.

Policies To Reduce Poverty Economics Help

Inequality And Poverty Policies

Government Policies To Reduce Income Inequality Microeconomics

Comments

Post a Comment